Introducing Mafin 2.5 - The Leading AI Model for Financial Question Answering

Mingtian

Ray

Mafin 2.5 Introduction

We are excited to introduce Mafin 2.5, our most advanced AI model built for financial professionals. Mafin 2.5 achieves a market-leading 98.7% accuracy on FinanceBench (the standard benchmark for financial question-answering), delivering state-of-the-art performance and setting a new standard for financial analysis. As your AI copilot, Mafin enhances investment research by helping you assess company financials, analyze market trends, evaluate risks, and stay informed with the latest reports — all with unparalleled accuracy, efficiency, and reliability to support your decision-making.

Detailed benchmark results are available in our GitHub repo.

Performance Benchmark

FinanceBench is an industry-standard benchmark designed to evaluate the performance of large language models (LLMs) on financial question answering (QA). It consists of questions about publicly traded companies that require finding answers directly from SEC filings (e.g., 10-K, 10-Q, 8-K). The following table shows some sampled questions from FinanceBench:

| Ticker | Question |

|---|---|

| AMD | Does AMD have a reasonably healthy liquidity profile based on its quick ratio for FY22? If the quick ratio is not relevant to measure liquidity, please state that and explain why. |

| JPM | Which of JPM's business segments had the lowest net revenue in 2021 Q1? |

State-of-the-Art Accuracy

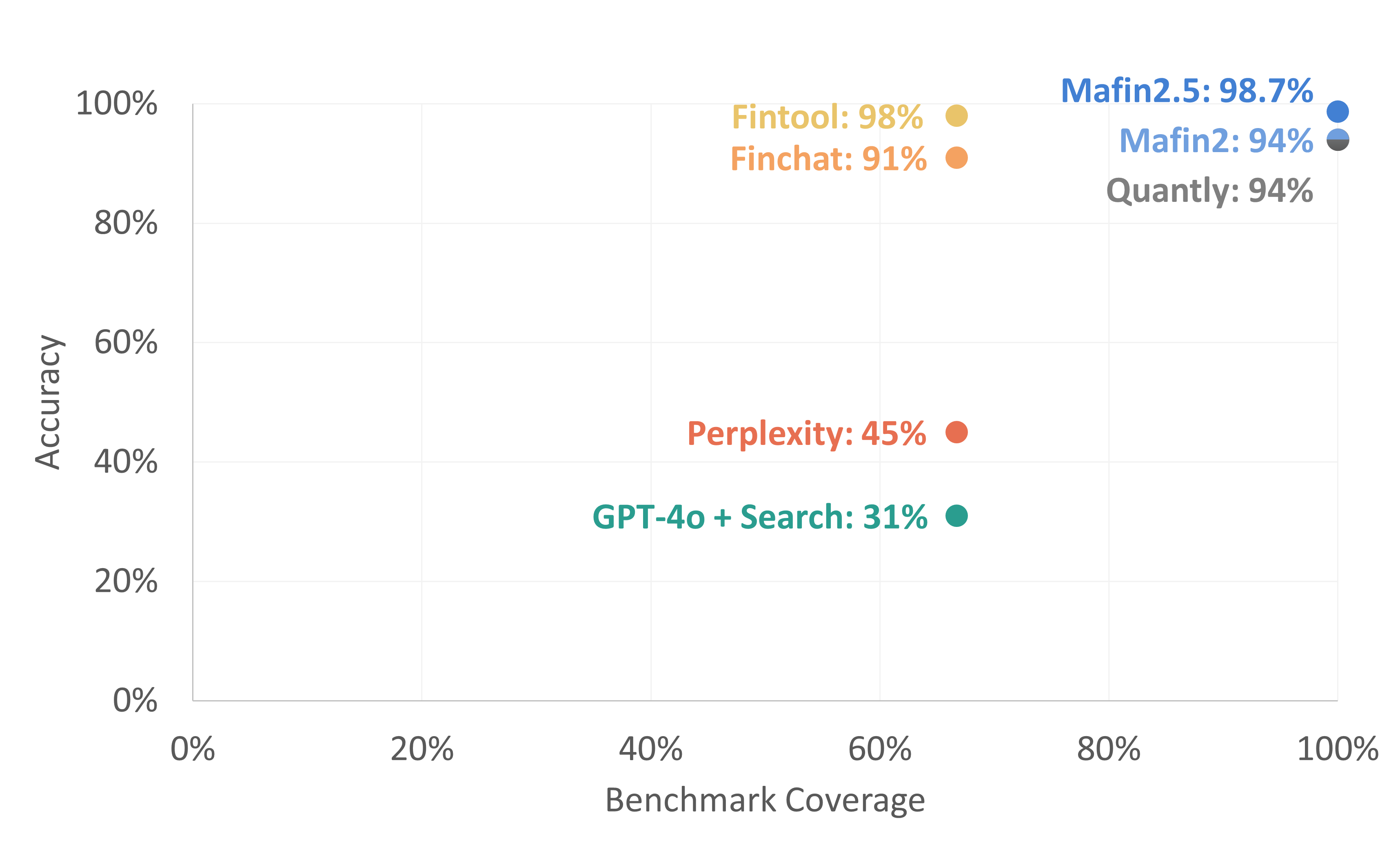

Mafin 2.5 achieves 98.7% accuracy when tested on the full benchmark dataset (100%), ensuring a more comprehensive and fair evaluation compared to models that only cover 66.7% of the dataset. We have open-sourced our benchmark results in the GitHub repo.

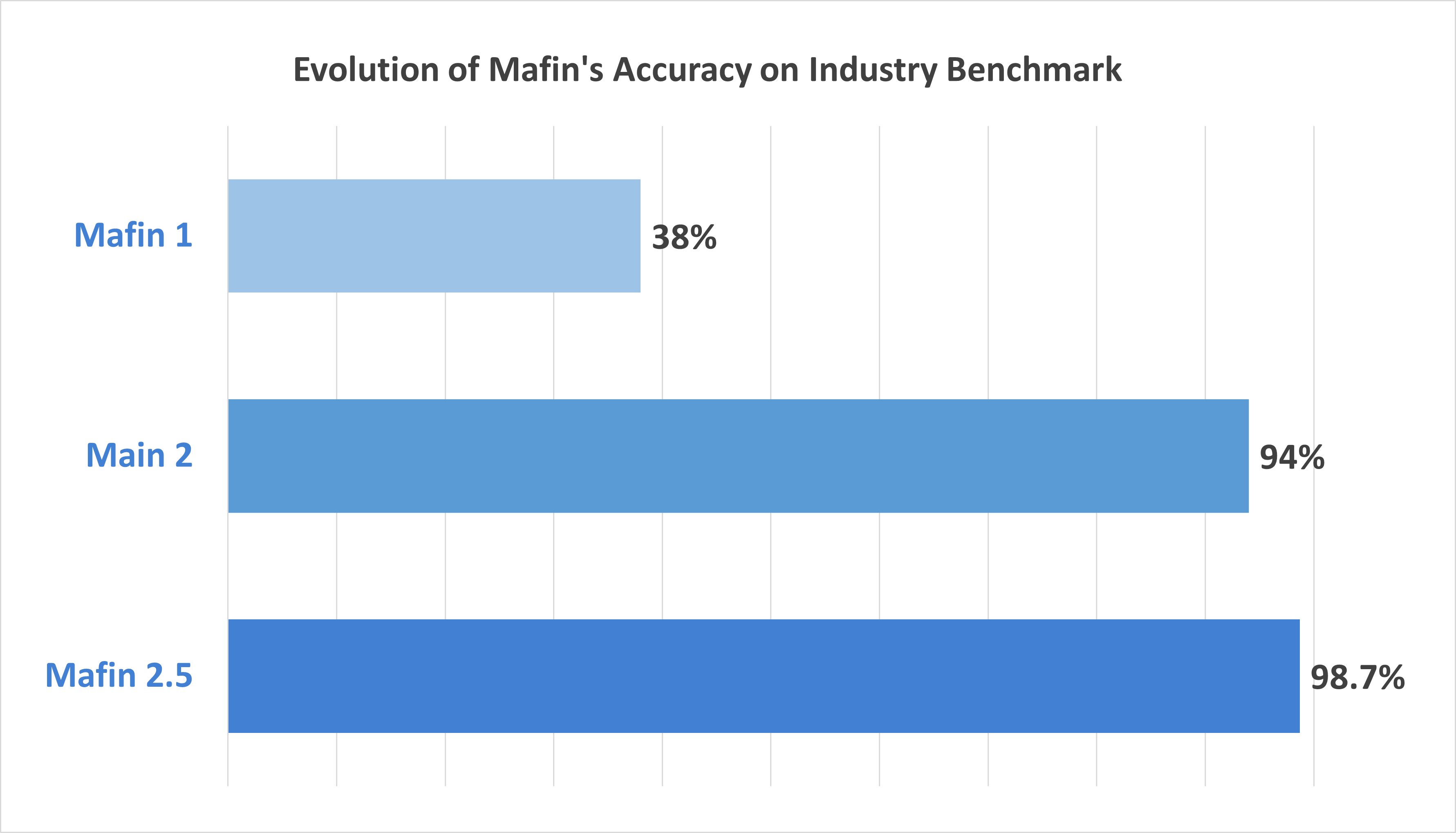

Continuous Improvement

From Mafin 1 to Mafin 2.5, we’ve continuously refined Mafin to improve its accuracy in financial question-answering capabilities. Each iteration brings better performance, deeper financial expertise, and more robust benchmark testing.

Features of Mafin

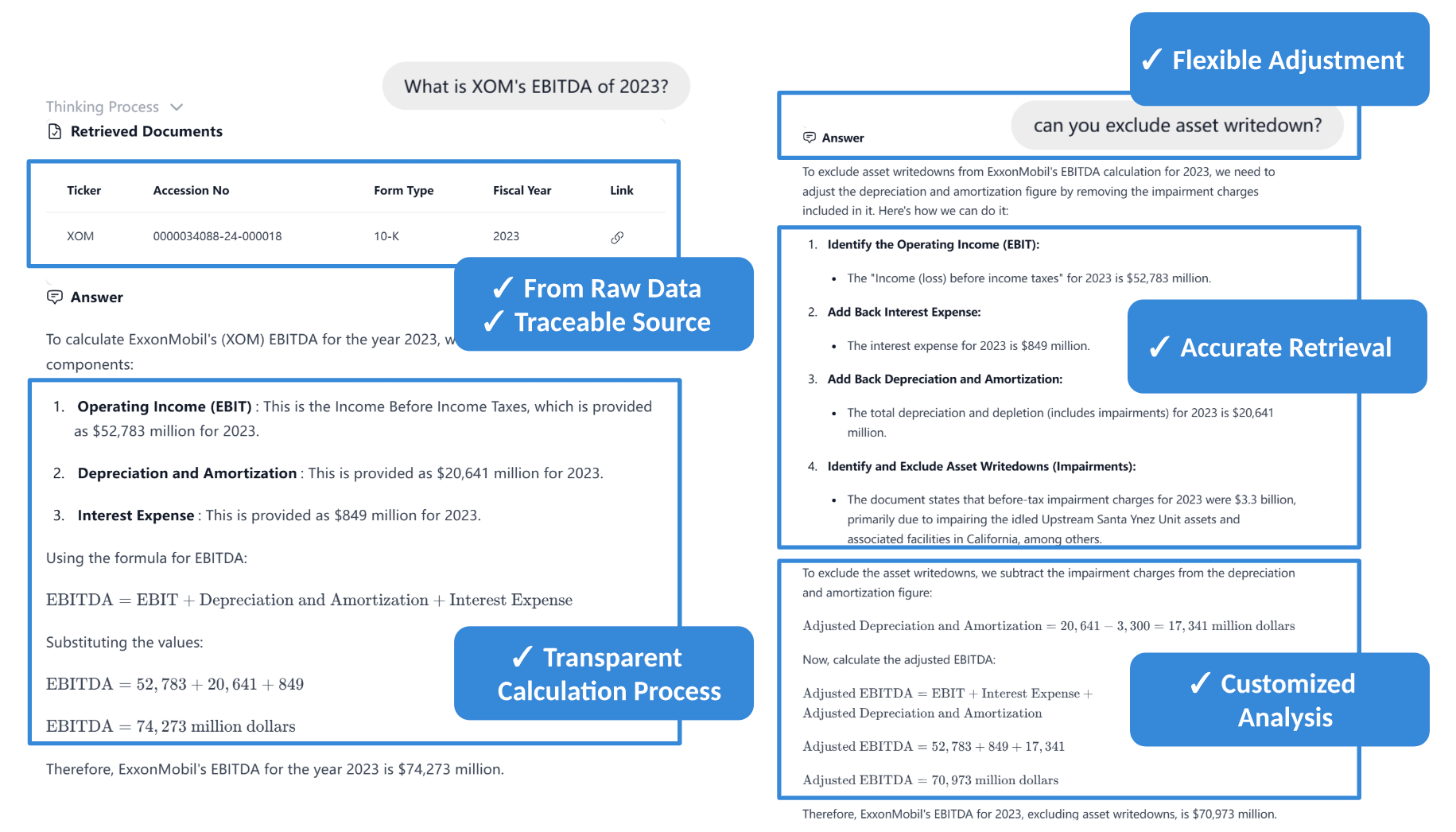

The Mafin platform has a conversational, interactive user interface, allowing analysts to interact with financial data just as they would with a real assistant — asking follow-ups, refining assumptions, and ensuring alignment with their preferred strategies.

- Accurate, Traceable Data Source – Every calculation is backed by raw financial filings, ensuring transparency and credibility.

- Transparent Calculation Process – Mafin breaks down each financial computation step-by-step, ensuring clear and explainable outputs.

- Customized Analysis – Users can apply specific adjustments to tailor insights to their needs.